Low fees are a symptom of deeper problems

People tend to celebrate times with low feer rates. It is time to clean the house, to consolidate all the utxos you need to wait, or to close and to enroll into the blockchain. They are perceived as a positive time.

You are not. We have seen an explosive price increase in the past few months and finally met the 100,000 USD benchmark, all of which considered predetermined during the last market cycle. This is not normal.

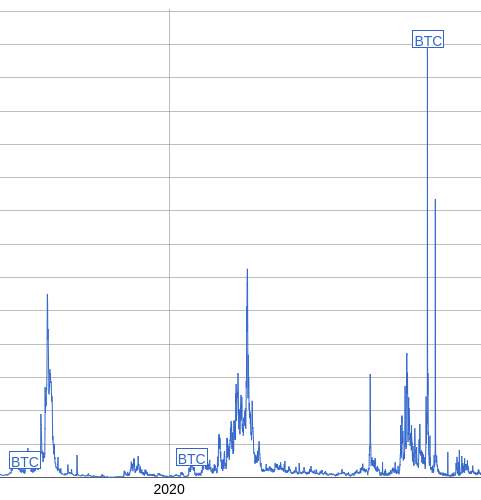

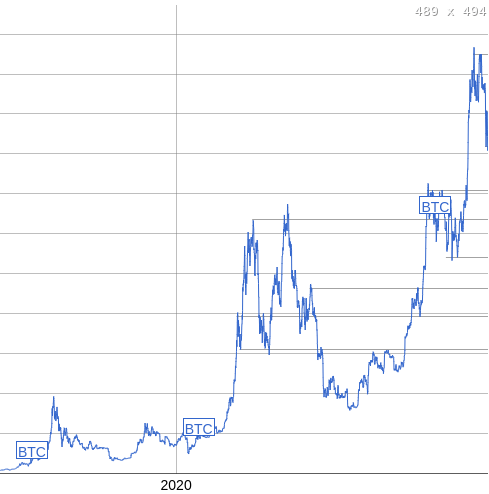

The picture on the left is the average feerate every day since 2017, the picture on the right is the average price every day since 2017. When the price was pumped, when it was very volatile, we historically viewed the growth and top value at the price. People actually bought and sold on chains, and people took custody for their own coins when they bought them.

This last leg of up to over 100,000 does not seem to have the same proportional influence on the feer rates, which previously moves in this cycle. If you have actually looked at these two diagrams, I am sure that many people are “What if this cycle is over?” It is possible, but let’s say it’s not for a second.

What else could that show? That the participants who drive the market change. A group of people who were previously dominated by people who managed themselves who managed their risk of counter-party by removing profits from stock exchanges, generating time-critical activities on the chain, transformed into a group of people who simply pass on ETF shares who do not have to define anything with Kaint.

It’s not a good thing. The nature of Bitcoin is defined by the users who interact directly with the protocol. Those who have private keys to approve transactions that generate income for miners. Those who are sent and verify transactions against consensus rules with software.

Bitcoin’s nature are at risk of both things that are removed from the hands of the users and laid behind the veil of the custody banks.

This is a serious existential problem that needs to be solved. The entire stability of the consensus over a certain series of rules is based on the assumption that there are sufficient independent actors with separate interests that differ, but align a value that is obtained by using these rules. The smaller the group of independent actors (and the larger the group of people who “use” Bitcoin as an intermediary by these actors, the more practical that they coordinate them to change them fundamentally, and the more likely it is that their interests as a group are synchronized by the interests of the larger group of secondary users.

If things develop in this direction, Bitcoin could very well embody nothing, which of us hope today that it can. This problem is technically, which scales the scaling of Bitcoin in such a way that users independently have control over their means to chains, even if they are only due to the worst case, but it is also a problem of incentive and risk management.

The system not only has to scale, but it must also be able to offer ways to alleviate the risks of self -observation in such a way that people from the traditional financial world are used to. Many of them actually need it.

This is not just a situation of “the same thing I do because it is the only right way”. This has something that has an impact on the basic properties of Bitcoin itself in the long run.

This article is an attitude. Opinions are exclusively those of the author and do not necessarily reflect that of the BTC INC or Bitcoin magazine.